puerto rico tax incentives 2021

The Code shall create a simple streamlined. As provided by Act 60.

Doing Business Puerto Rico Tourism Company

The Tax Incentive Code includes a special regime for individual investors willing to relocate to Puerto Rico.

. Act 60 In June 2019 Puerto Rico made substantial changes to its tax incentives that came into effect on January 1 2020. You can access the Puerto Rico Tourism Companys Virtual Clerk to request incentives. The purpose of Act 60 is to promote investment in Puerto Rico by providing investment residents with tax breaks.

That means zero tax compared to 30 40 in the United States. The Islands incentive package for the tourism and hospitality industry is equally enticing. New residents are fully exempt from income taxes on all passive income such as dividends and interest.

The countrys tax collector quietly launched a coordinated campaign in late January to examine individuals who took advantage starting in 2012 of tax incentives designed to lure high net-worth. Incentives Eligible Businesses Financial Report Energy Bill Credit Documents Please Read. For taxable years beginning after 31 December 2019 taxpayers who are residents of Puerto Rico during the entire year who are 27 years old and beyond will be entitled to claim the EIC.

Also during the year 2012 two additional laws were enacted. This makes Puerto Rico most ideal for high earning business owners as anything in excess of the USD 50000 salary would only be taxed at the 4 corporate tax rate so the more that is earned the greater the tax benefits. 27 2021 the Internal Revenue Service IRS announced a new compliance campaign focusing on the Puerto Rico Act 22 now Act 60.

Unlike Canadians Australians Brits Italians etc. Act 20 and Act 22 promoting the export of services from Puerto Rico and the transfer of wealthy individuals to Puerto Rico. Feb 08 2021 Share Authored by Manny Muriel On Jan.

The Incentives in a Nutshell Legacy Act 20 generally provides for a 4 tax rate on income from specified export activity. Dividends paid from your bank to a qualifying resident of Puerto Rico are tax-free. Purpose of Puerto Rico Incentives Code Act 60.

Act 60 consolidated various tax decrees incentives subsidies and benefits including Acts 20 and 22. Interest and dividends that qualify as Puerto Ricosourced income are not subject to federal income taxes. This would apply to an entrepreneur shareholder.

The Puerto Rican government is luring businesses and investors to their beautiful island with attractive tax incentives like a 4 corporate tax rate and a 0 tax rate on capital gains. According to recent statements in September of 2021 by the Secretary of the Department of Finance of Puerto Rico Francisco Pares Alicea and John Siddons of IRS criminal investigations more than 20 IRS agents and accountants are on the island collaborating with the Puerto Rican government to identify cases of tax evasion. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investorsIn a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business here.

The credit will range from 5 to 125 of the gross earned income subject to limitations depending on the amount of dependants claimed by the taxpayer. In 2008 a new Economic Incentives Act for the Development of Puerto Rico herein after Act 73 or Economic Incentives Act went into effect. This Code is approved with the conviction that it shall improve Puerto Ricos economic competitiveness.

Americans cant just move to a tax-friendly country and completely disconnect from the US tax system saving big on taxes. Many sizable tax breaks like these are offered across a variety of industries making Puerto Rico Americas last true tax haven. Ad We file Puerto Rican Hacienda US and Canadian returns.

The IRS demands its share of Americans incomes for life. A bona-fide resident of Puerto Rico can avoid including all or part of the income or dividends from the company in US. The act shall have a term of 15 years until December 31 2030 and renewable for 15 years.

June 10 2021 Living Abroad Mitigate Taxes By Living Abroad Puerto Rico The American tax system is unique. Under this new law known as the Incentives Code Acts 20 and 22 have been consolidated into Act 60 and were subsequently renamed. If you operate a business from Puerto Rico such as a call center to support your bank you might qualify for a 4 rate on that business income also.

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/bloomberglinea/5RZ5UOOCQVEVRONJL6IGT25JDA.png)

Zero Taxes Golf And Beach Houses Create A Crypto Island Paradise

Moving To Puerto Rico With 4 Kids Tax Benefits Of Living In Puerto Rico Otosection

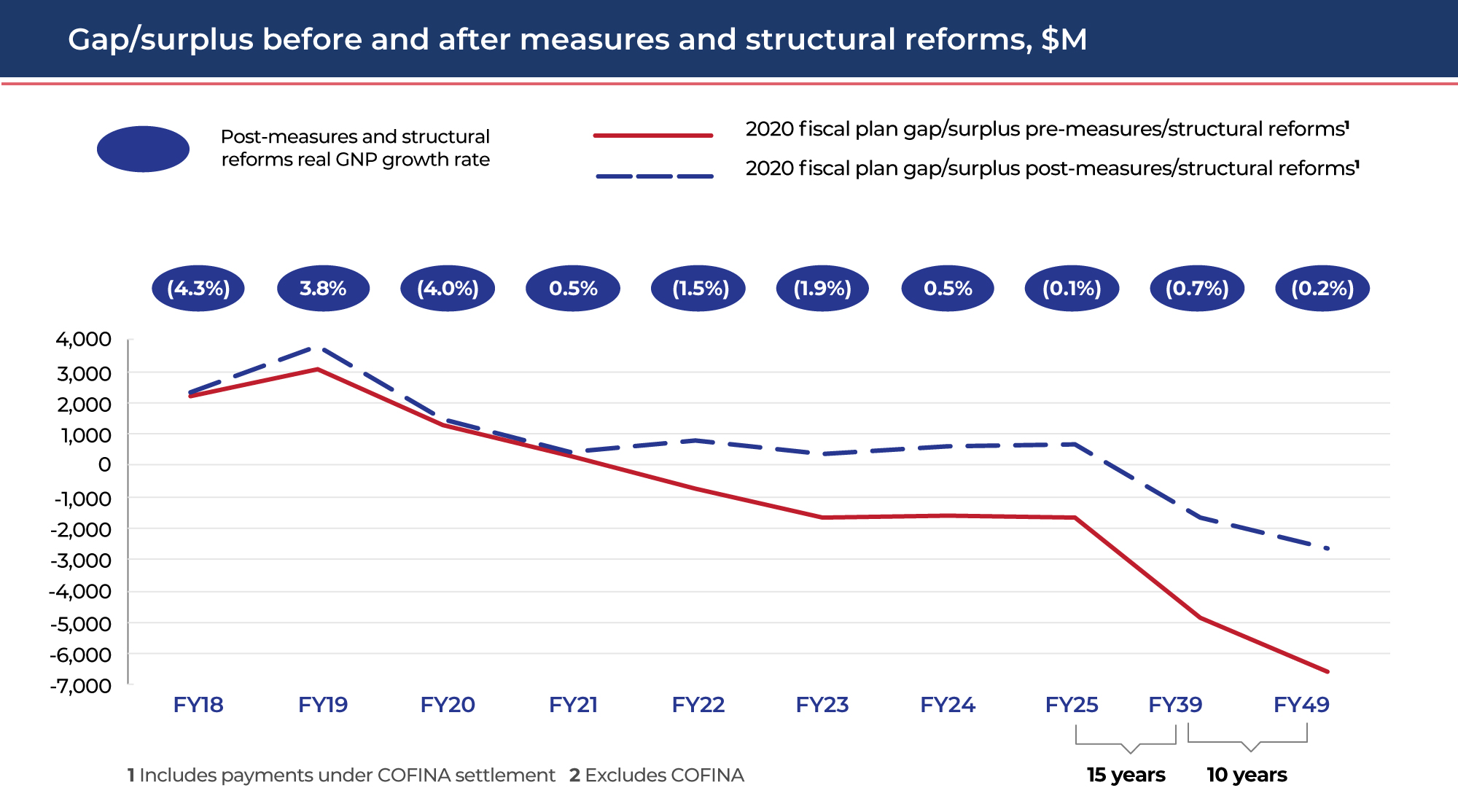

Cw Fiscal Plan Financial Oversight And Management Board For Puerto Rico

Here S How Residents Of Puerto Rico Can Opt In To Paying Child Tax Credits World Time Todays

Cw Fiscal Plan Financial Oversight And Management Board For Puerto Rico

Puerto Rico Qualified Small Business Stock Qsbs And Investor Tax Incentives Qsbs Expert

Sm Best Places Pr Report Puerto Rico Person Guide

Sm Best Places Pr Report Puerto Rico Person Guide

How To Prepare For A Move To Puerto Rico To Enjoy Lucrative Tax Incentives Relocate To Puerto Rico With Act 60 20 22

Sm Best Places Pr Report Puerto Rico Person Guide

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

New Puerto Rico Debt Plan Is A False Solution Crafted To Benefit Capitalists

Sm Best Places Pr Report Puerto Rico Person Guide

New Puerto Rico Tax Incentives Code Act 60 Explained 20 22

How To Prepare For A Move To Puerto Rico To Enjoy Lucrative Tax Incentives Relocate To Puerto Rico With Act 60 20 22

New Puerto Rico Tax Incentives Code Act 60 Explained 20 22

Audit Supervisor Average Salary In Puerto Rico 2022 The Complete Guide

Previous To Moving To Puerto Rico Appreciation Loss Capital Gains Torres Cpa

How Do I Pay My Puerto Rico Excise Tax Import Tax With Pictures